Jeevan Utsav Plan

Whole Life Insurance plan. This plan provides financial support to family in case of unfortunate death of Life Assured and survival benefits in the form of Regular Income Benefit or Flexi Income Benefit as per the option chosen for surviving policyholder.

Have any Questions?

Call us Today!

LIC (Life Insurance Corporation of India) has launched a unique financial plan that combines individual savings with whole life insurance. Known as LIC Jeevan Utsav, this plan became effective on November 29, 2023. Jeevan Utsav is an Individual, Non-Linked, Non-Participating, Savings, Whole Life Insurance plan offered by LIC. It offers financial assistance to the family in the event of Life Assured’s unfortunate demise and provides survival benefits in the form of Regular Income Benefits or Flexi Income Benefits, depending on the option chosen by the surviving policyholder. This non-participating product ensures that benefits paid upon death or survival remain guaranteed and fixed, regardless of experience. As a result, the policy does not qualify for discretionary benefits such as bonuses or a share in surplus. Additionally, the plan offers the flexibility to make limited premium payments while incorporating guaranteed additions throughout the premium-paying term.

Guaranteed Additions

For every policy year in which the premium is paid under this plan, guaranteed additions of Rs. 40 per thousand basic sum assured will accumulate at the conclusion of each policy year throughout the premium-paying term. Upon the survival of the life assured after the premium-paying term, the policyholder has the option to choose between Regular Income Benefit and Flexi Income Benefit.

Survival Benefit

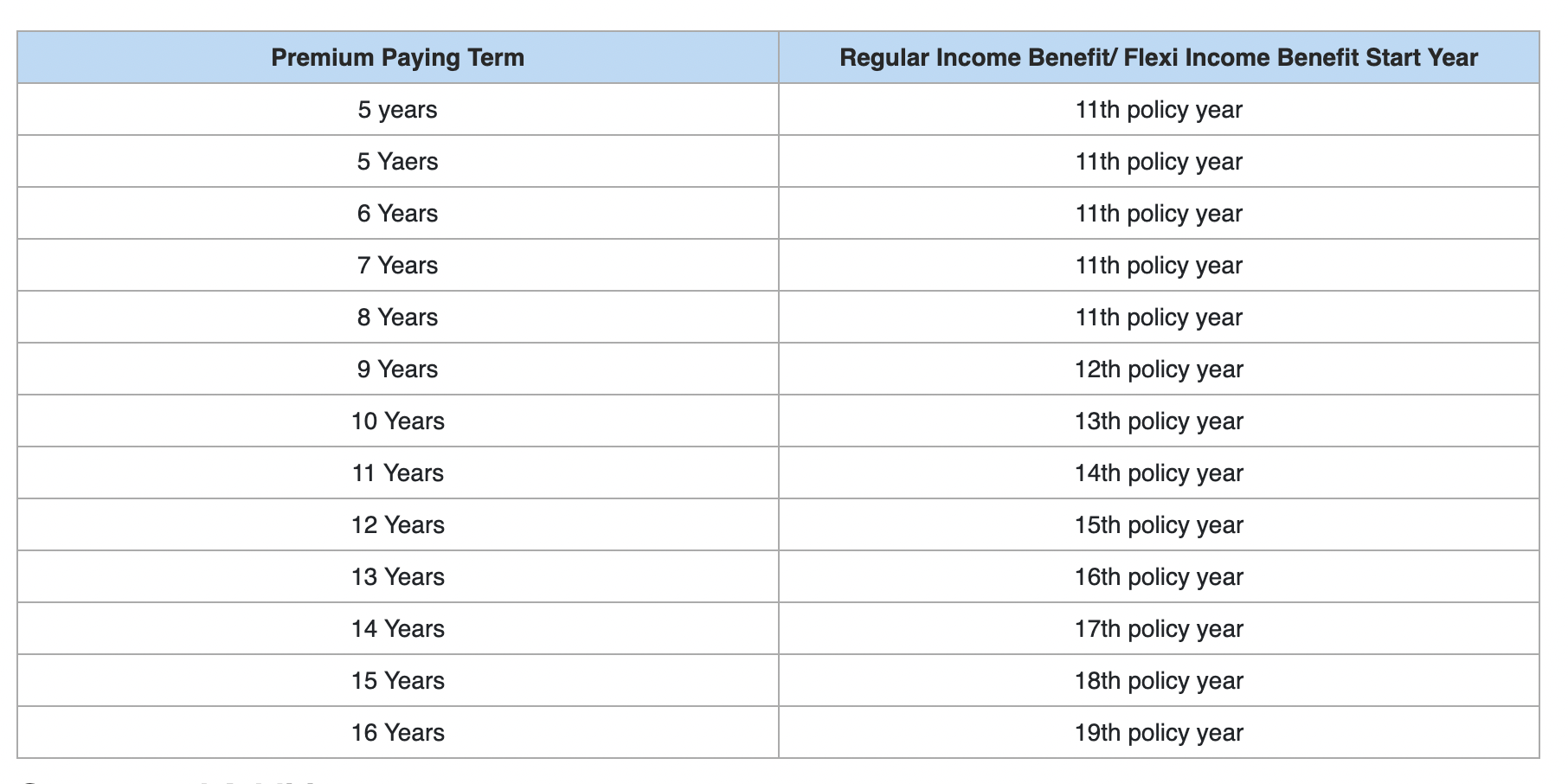

The Survival Benefit, in the form of either a Regular Income Benefit or Flexi Income Benefit, is outlined as follows based on the chosen option:

Option I – Regular Income Benefit

Upon the survival of the Life Assured, a Regular Income Benefit equivalent to 10% of the Basic Sum Assured will be disbursed after each policy year. This commences from the specified year in Table 1 below, contingent upon the payment of all due premiums.

Option II – Flexi Income Benefit

Upon the survival of the Life Assured, the policyholder qualifies for the Flexi Income Benefit, amounting to 10% of the Basic Sum Assured. This benefit will be disbursed after each policy year.

What Are The Key Features and Benefits of LIC Jeevan Utsav?

Here are the salient features and benefits of LIC Jeevan Utsav.

Death Benefit

In the unfortunate event of the life-assured passing away after the commencement of risk, the death benefit will be the sum assured on death, along with accrued guaranteed additions, provided the policy is in force. The minimum death benefit will be 105% of the total premiums paid up to the date of death. The sum assured on death is determined as the basic sum assured or seven times the annualized premium, whichever amount is higher.

Grace Period

Policyholders are granted a grace period of 30 days for yearly, half-yearly, or quarterly premium payments, and 15 days for monthly premiums, beginning from the date of the First Unpaid Premium. During this period, the policy will maintain its active status, ensuring continuous risk coverage in line with the policy terms. It’s important to note that failure to settle the premium by the end of the grace period will result in the policy lapsing.

Surrender Benefit

The policyholder has the option to surrender the policy at any time, provided that two full years’ premiums have been paid. Upon surrender, the amount payable will be the higher of the Guaranteed Surrender Value (GSV) or the Special Surrender Value (SSV).